Our next system development project at the Owl Bundle User Group (OBUG) is the Logic Chain Trading System. The Logic Chain System is inspired by the work of Dr. Ken Long and is being implemented using EdgeRater for large-scale backtesting, multifactor analysis, and Monte Carlo validation. This project represents a natural evolution in how we think about markets, sectors, systems, and symbols — and how they should work together in a disciplined trading framework.

Rather than asking, “What stock should I trade?”, the Logic Chain asks: Under current conditions, where is capital flowing — and which trading edge is structurally aligned with that flow?

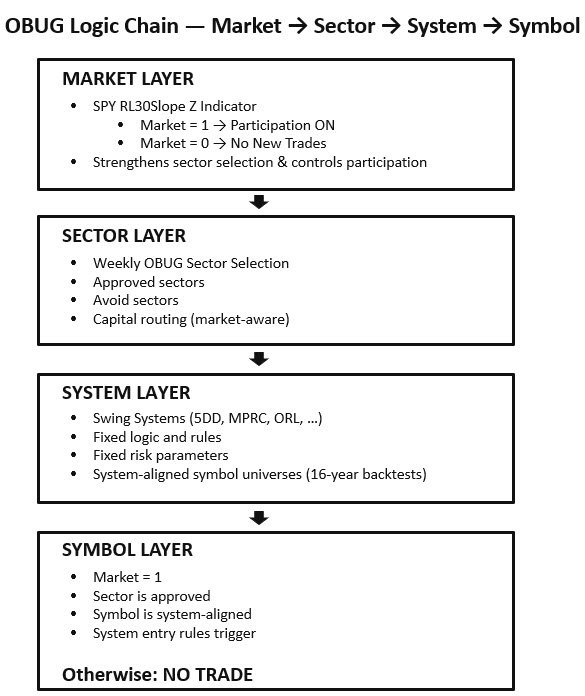

The Core Idea: The Logic Chain

The Logic Chain framework organizes trading decisions into a clear, hierarchical process:

Each layer has a specific and well-defined role:

Market context provides participation guidance and strengthens sector selection

Sector selection determines where capital is eligible to flow

Systems define the trading edge and execution logic

Symbols are traded only when all upstream conditions align

This structure enforces discipline and removes ambiguity. When conditions do not align across the chain, no trade is taken — by design.

Why Build a Logic Chain System?

Many trading strategies fail not because their entry rules are flawed, but because of structural weaknesses in how they are applied:

Symbols are traded without regard to sector context

Sectors are traded without regard to market conditions

Systems are applied indiscriminately across environments

Risk is evaluated trade-by-trade instead of at the portfolio level

The Logic Chain System addresses these weaknesses by separating responsibility across layers and ensuring that each decision is made at the correct level.

This approach is not about finding more trades.

It is about taking fewer, higher-quality trades with better risk control.

The Institutional Parallel: How Capital Is Actually Allocated

The Logic Chain framework mirrors how major institutions and professional asset managers allocate capital.

Institutions rarely begin with individual securities. Instead, they ask:

Where is capital allowed to flow under current conditions?

That decision is made top-down and revisited regularly—often weekly or monthly—based on observed market behavior, risk conditions, liquidity, and mandate constraints.

At a high level, the institutional allocation process looks like this:

Market context determines overall participation and risk appetite

Sector and asset-class rotation determines where incremental capital is eligible

Strategy or style selection determines how capital should be deployed

Instrument selection provides execution once all upstream conditions align

This reflects a Logic Chain in practice —even if it is not labeled as such.

Institutions are generally responding to observed conditions rather than forecasting outcomes, routing capital toward areas that meet predefined criteria and withholding capital when alignment is absent.

How We’re Building It

Long-Horizon System Backtesting

Each Swing System is evaluated using 16 years of historical data across a broad universe of liquid equities. The objective is to identify structural system–symbol compatibility across multiple market regimes. Each system ultimately results in a pre-defined, system-aligned symbol universe.

Sector Attribution (Not Optimization)

Symbols are tagged by sector to understand where each system naturally expresses edge. Sectors are treated as context and capital routing, not as curve-fitting tools.

Monte Carlo Validation

We use Monte Carlo analysis to examine:

Distribution of outcomes

Left-tail risk

Drawdown behavior under adverse sequencing

This step shifts the focus from average performance to robustness under stress.

Below is a NotebookLM video overview of our Logic Chain Framework.

What Comes Next

The Logic Chain Trading System will be studied, tested, and refined inside the Owl Bundle User Group (OBUG) as an ongoing research and development effort, not as an already-finished or guaranteed trading system.

As with all AbleWayTech projects:

Assumptions will be tested

Results will be documented

Weaknesses will be exposed—not hidden

There is no guarantee that this research will result in a deployable or superior trading system.

Some ideas may advance.

Some will be modified.

Some may be abandoned entirely.

That uncertainty is not a weakness—it is a core part of a disciplined learning and system-development process.

Our goal is not to promise certainty, but to work towards a repeatable, defensible trading system that stands up across market cycles.

Joining the Owl Bundle User Group (OBUG)

OBUG is where this kind of work happens.

Members don’t just see finished systems — they see how systems are built, why design decisions are made, and how risk is evaluated across time and regimes.

If you’re interested in:

Developing a structured trading framework

Understanding how market, sector, and system layers interact

Learning through real research rather than hindsight examples

We invite you to join the Owl Bundle User Group (OBUG) and follow the Logic Chain System as it is developed.

— AbleWayTech